Performance Of Your Company

FY 2019-20 will go down as a milestone year in the history of your Company on the back of elevated growth in Revenues and Profitability combined with opening up of new vistas of growth. More importantly, your Company embarks into golden jubilee year as it celebrates its 50th year of operation. Your Company continued to make investments to further strengthen its product portfolio as well as elevate its operational capabilities as it achieved greater economies of scale. All this has not only resulted in improved performance, but also helped to enrich your Company's position as a leading chemical manufacturer from India. Over the past year, your Company has continued its efforts towards innovative skills, perseverance and ingenuity. The strategic decisions undertaken to expand your Company's facilities in acalibrated manner are testament to its efforts of being future ready and delivering to its commitment of sustainable growth.

Your Company's performance was largely in-line with the expected shift of global supply chains from China to other reliable markets including India. Sensing this opportunity, your Company was quick to structure its production to favour products that enjoy a more favourable demand scenario. Your Company's continuous focus on quality, environmental standards, human resource practices and efficiency in hazardous and complex chemical processes makes it the supplier of choice for large global customers.

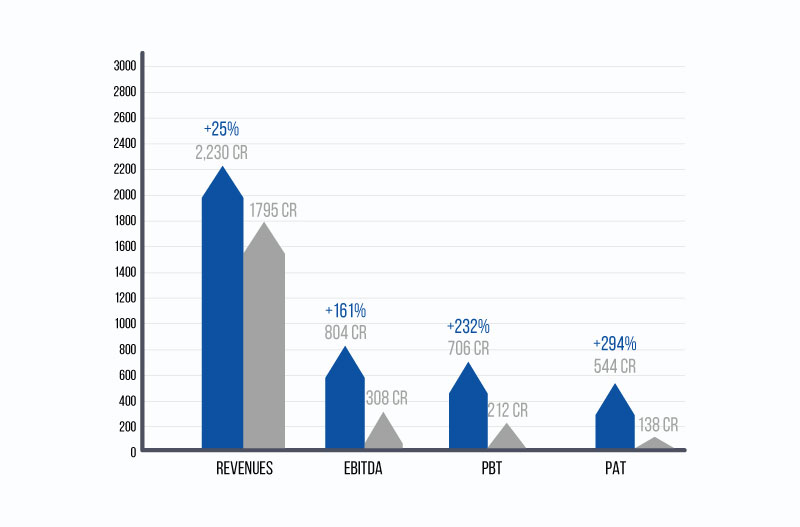

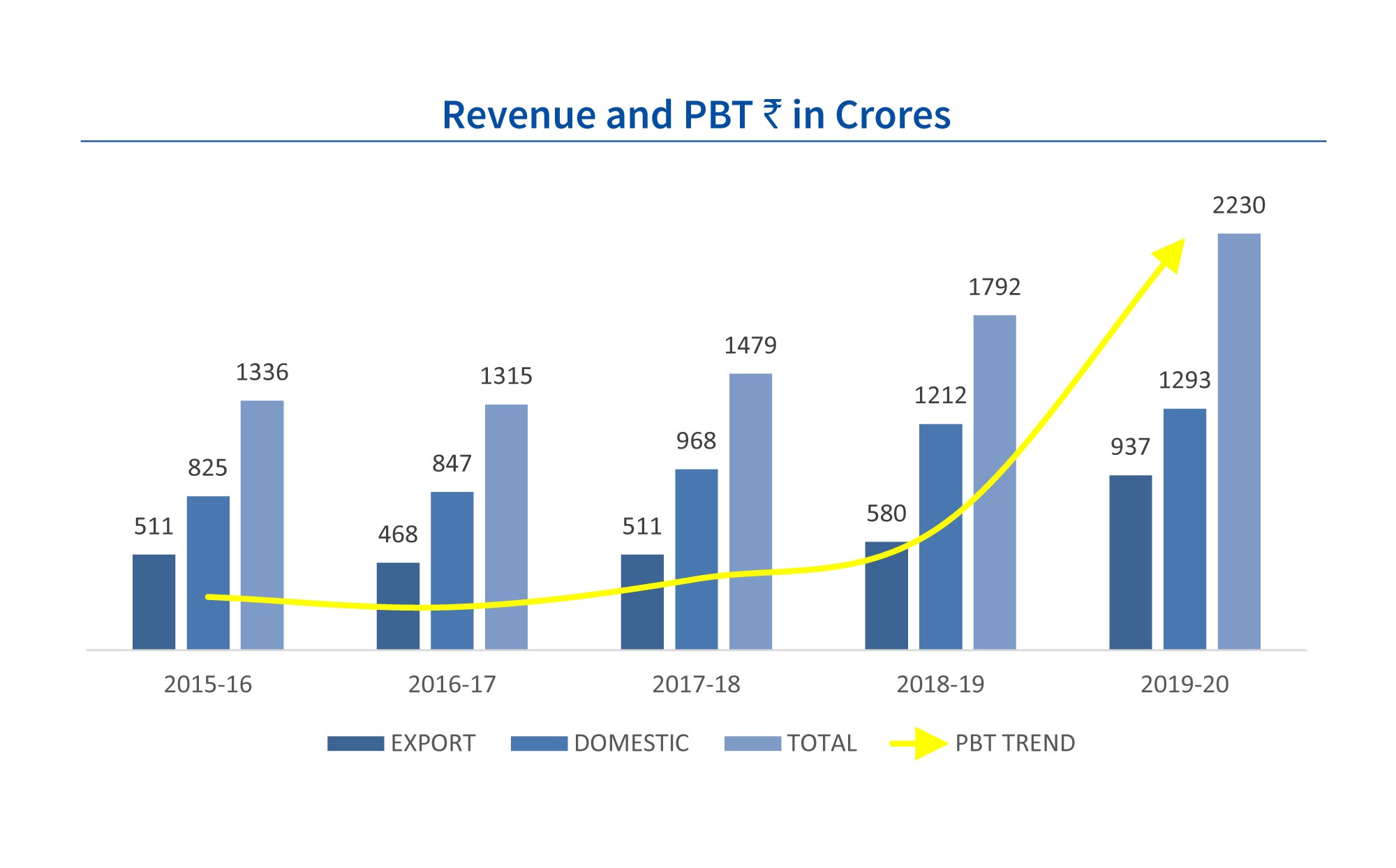

During the year under review, your Company demonstrated strong all-round performance led by healthy growth across its Strategic Business Units (SBUs). On a Standalone basis, revenues climbed to ₹ 2,230 Crores, 25% higher than the previous year. EBITDA registered at ₹ 804 Crores, up by 161% from the previous year resulting to EBITDA margins of 36%, higher by 18.77%. The expansion of margins was an outcome of enhancements in the product mix, improved realizations and cost reduction efforts undertaken at Company level. Profit Before Tax (PBT) was recorded at ₹ 706 Crores, up by 232% from last year. Profit After Tax (PAT) stood at ₹ 544 Crores, representing an improvement of 294% compared to FY 2018-19. This performance has been partially caused by supernormal realisation in DASDA owing to China's temporary disruption and hence may be seen in light of this.

Majority of your Company's turnover entails from the Domestic Revenues which stood at 58% of Total Revenues and the rest 42% came from Exports. Backed by steady demand from key end-user industries, the Domestic Revenues grew by 7%, while solid demand in key Export geographies resulted in 61% increase in Export Revenues; however, this strong Export performance has been partially caused by DASDA Export.

The combination of higher realisations as well as strong volume growth supported the performance momentum during the year since all SBUs have performed well. Demand in the end-user industries remained robust and your Company capitalized on these growth opportunities across global markets by demonstrating agility and nimbleness throughout its operations. Moreover, given the agile nature of its business, it was able to transfer its production quickly to key products that experienced better demand situation.

Your Company's wholly owned subsidiary, Deepak Phenolics Limited (DPL) reported its first full year of operations. Due to this, your Company reported robust momentum on a consolidated basis too. With the capacity to manufacture 200,000 MTPA of Phenol and 120,000 MTPA for co-product Acetone, supported by the capacity to manufacture 260,000 MT of cumene for captive consumption, Deepak Phenolics has demonstrated success in operating a global scale plant efficiently during the year as it recorded high capacity utilization of above 90% on a sustained basis.

With its vision of developing value-added downstream derivatives and thereby strengthening its business model, DPL in April 2020 commissioned a 30,000 MTPA plant at Dahej to manufacture Isopropyl Alcohol (IPA) from Acetone, thus significantly reducing the country’s dependence on imports. IPA is an important input in production of essential pharmaceuticals and sanitizers.

In FY 2019-20, your Company invested ₹ 270 Crores towards initiatives on capacity expansion and debottlenecking of existing plants. This expenditure also covers the new 125-acre land purchased at Dahej during the year. This land is strategically located surrounded by key suppliers and customers paving path for ample opportunity of growth.

In appreciation of the continued support of all the shareholders, the Board of Directors of your Company had declared an Interim Dividend of ₹ 4.50 per Equity Share in FY 2019-20, on a Face Value of ₹ 2 per Equity Share. The rate of Interim Dividend was 225% as against Final Dividend of 100% , being ₹ 2 per Equity Share in FY 2018-19.