General Shareholder Information

Annual General Meeting

Day & Date: Friday, August 7, 2020

Time: 11:30 A.M

Venue: Through Video Conference / Other Audio Visual Means (‘VC’/ ‘OAVM’)

Financial Year: April 1 to March 31

Record Date / Book Closure : July 31, 2020 to August 7, 2020 (both days inclusive)

Dividend payment date : The payment of Interim Dividend was made through electronic mode on March 21, 2020 to all the Equity Shareholders whose Bank Account details were available with your Company. However, your Company was not able to complete dispatch of Interim Dividend Warrants within the prescribed time limit on account of situation emerged due to outbreak of COVID-19 and the orders of Central / State Government for lockdown effective from March 23, 2020. Your Company shall endeavor to complete the dispatch of Interim Dividend Warrants upon resumption of services by Postal Authorities.

Financial Calendar

Results for the Quarter ending |

Tentative Time of Reporting |

|---|---|

June 30, 2020 |

On or before August 14, 2020 |

September 30, 2020 |

On or before November 14, 2020 |

December 31, 2020 |

On or before February 14, 2021 |

Audited Annual Accounts for the year ending March 31, 2021 |

On or before May 30, 2021 |

Listing on Stock Exchanges

The Company’s Equity Shares are listed on the following Stock Exchanges:

Name: BSE Limited (“BSE”)

Address: Pheroz Jeejeebhoy Towers, Dalal Street, Fort, Mumbai.

Name: National Stock Exchange of India Limited (“NSE”)

Address: Exchange Plaza, C-1,Block-G, Bandra Kurla Complex, Bandra (E) Mumbai.

The requisite Listing fees for Financial Year 2020-21 has been paid to both the Stock Exchanges.

The Commercial Papers issued by the Company have been listed on BSE.

The Securities of the Company have not been suspended from trading during the Financial Year 2019-20.

Stock Code for Equity Shares (BSE): 506401

Stock Code for Commercial Papers: 718632

Stock Symbol for Equity Shares (NSE): DEEPAKNTR

ISIN Number for Equity Shares (NSDL & CDSL): INE288B01029

ISIN Number for Commercial Papers (NSDL & CDSL): INE288B14378

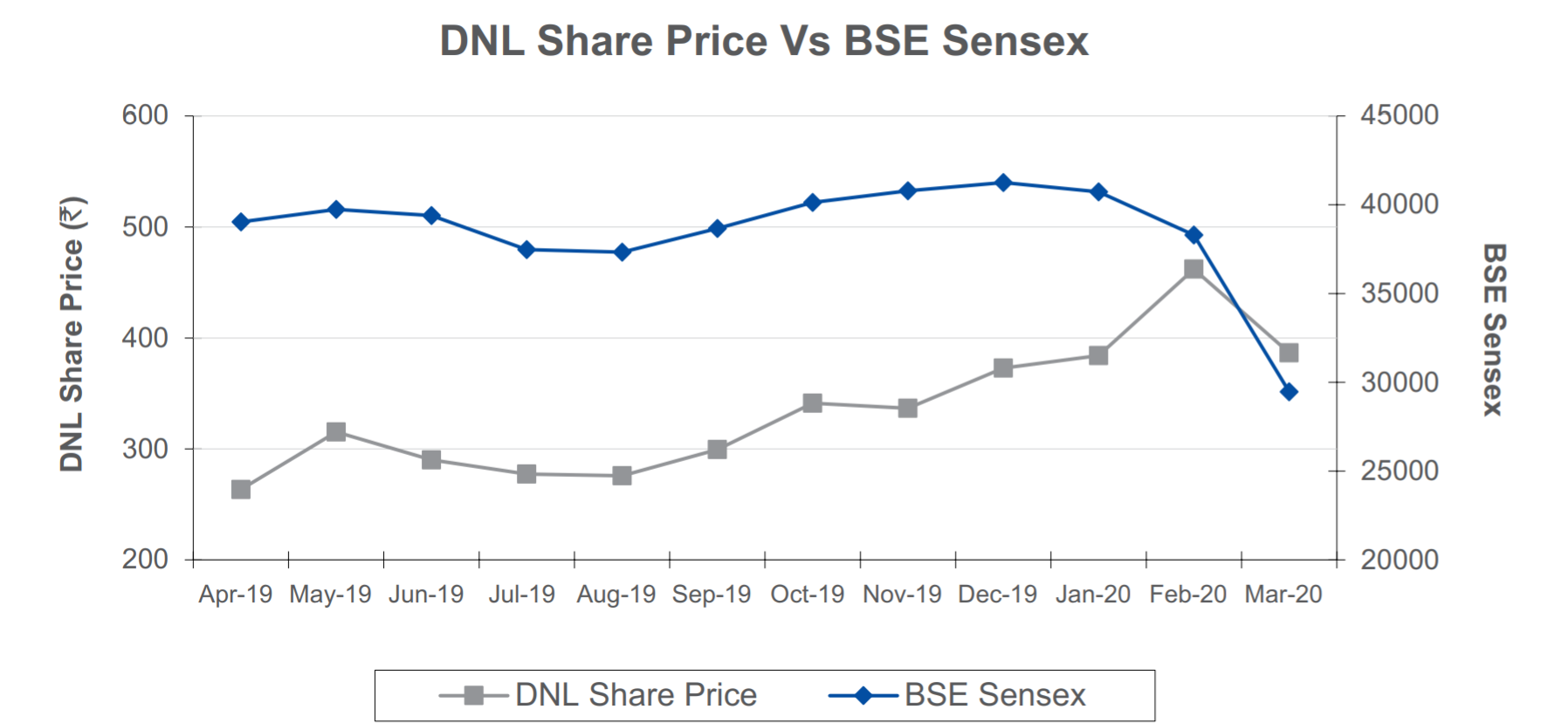

Market Price Data of Equity Shares

Monthly High & Low during the Financial Year 2019-20 at BSE and NSE:

Month |

BSE |

NSE |

||

|---|---|---|---|---|

|

High(₹) |

Low(₹) |

High(₹) |

Low(₹) |

April, 2019 |

284.75 |

255.00 |

284.85 |

254.75 |

May, 2019 |

325.85 |

263.00 |

325.30 |

263.00 |

June, 2019 |

337.55 |

265.00 |

337.95 |

264.25 |

July, 2019 |

317.90 |

269.00 |

317.45 |

266.75 |

August, 2019 |

299.00 |

256.95 |

299.00 |

257.30 |

September, 2019 |

320.05 |

267.55 |

319.90 |

267.00 |

October, 2019 |

359.80 |

285.10 |

360.00 |

286.05 |

November, 2019 |

377.45 |

332.25 |

377.00 |

334.10 |

December, 2019 |

386.70 |

325.55 |

386.75 |

325.00 |

January, 2020 |

410.00 |

364.55 |

409.60 |

365.10 |

February, 2020 |

520.70 |

372.20 |

520.80 |

371.45 |

March, 2020 |

543.40 |

310.00 |

542.50 |

310.00 |

Source: Respective Websites of BSE and NSE.

Distribution of Shareholding as on March 31, 2020

Range |

No. of Holders |

% |

No. of Shares |

% |

|---|---|---|---|---|

1 – 500 |

61,770 |

89.21 |

47,690,36 |

3.50 |

501 – 1000 |

2,976 |

4.30 |

23,93,086 |

1.75 |

1001 – 5000 |

3,391 |

4.90 |

77,86,219 |

5.71 |

5001 – 10000 |

614 |

0.89 |

43,06,043 |

3.16 |

10001 & above |

487 |

0.70 |

11,71,38,657 |

85.88 |

TOTAL |

69,238 |

100.00 |

13,63,93,041 |

100.00 |

Shareholding Pattern as on March 31, 2020

Category of Shareholders |

No. of Shares |

% to Equity Capital |

|---|---|---|

Promoters & Promoter Group |

6,23,19,968 |

45.69 |

Mutual Fund |

2,08,03,669 |

15.25 |

Financial Institutions, Banks, Insurance Companies |

9,58,119 |

0.70 |

Foreign Portfolio Investor |

1,49,54,542 |

10.96 |

Bodies Corporate |

68,05,170 |

4.99 |

Non Resident Individuals |

12,88,964 |

0.95 |

Resident Individuals |

2,66,22,276 |

19.52 |

Others |

26,40,333 |

1.94 |

TOTAL |

13,63,93,041 |

100.00 |

The Company does not have any outstanding Global Depository Receipts or American Depository Receipts or warrants or any convertible instruments

Dematerialisation of Equity Shares

Electronic holding by Members comprises 99.19 % of the paid up Equity Capital of the Company as on March 31, 2020 held through National Securities Depository Limited and Central Depository Services (India) Limited.

Share Transfer System

Share transfers are processed and Share Certificates duly endorsed are delivered within a period of 15 days from the date of receipt, subject to documents being valid and complete in all respects. All requests for dematerialisation of securities are processed and the confirmation is given to the Depositories within 15 days.

Pursuant to Regulation 40(9) of the Listing Regulations, certificates, on half yearly basis have been issued by a Company Secretary-in-Practice for due compliance of share transfer formalities by the Company. Pursuant to Regulation 76 of SEBI (Depositories and Participants) Regulation, 2018, certificates have been received from a Company Secretary-inPractice for timely dematerialisation of shares and for reconciliation of the share capital of the Company on a quarterly basis.

Registrar and Share Transfer Agent

Contact details of Link Intime India Private Limited:

Mumbai Office:

C-101, 247 Park, L.B.S.Marg,

Vikhroli (W),

Mumbai - 400 083

Tel: 022 - 2594 6970

Toll free number: 1800 1020 878

Email: [email protected]

Investor Relation Centre:

B-102-103, Shangrila Complex,

1st Floor, Opp. HDFC Bank,

Near Radhakrishna Chhar Rasta,

Akota, Vadodara 390 020

Tel: 0265 - 2356 573 / 2356 794

Fax: 0265 - 2356 791

E-mail : [email protected]

Address for Correspondence and Investor Assistance

Deepak Nitrite Limited

Aaditya-I, Chhani Road,

Vadodara - 390 024

Contact Person: Shri Arvind Bajpai

Telephone Numbers:(0265) 2765200. 3960200

Fax No. : (0265) 2765344

E-mail : [email protected]

Website : www.godeepak.com

Shareholders holding shares in electronic mode should address all their correspondence related to change of address or Bank details or NECS mandate to their respective Depository Participants.

Unclaimed/Unpaid Dividend

As per the provisions of Section 124 of the Act the Company is required to transfer unclaimed dividends, matured deposits and interest accrued thereon remaining unclaimed and unpaid for a period of seven years from the due date to the Investor Education and Protection Fund (IEPF) set by the Central Government.

Given below are the tentative dates for transfer of unclaimed and unpaid dividend to the Investors Education & Protection Fund (IEPF) by the Company:

| Financial Year | Dividend Declaration Date | Tentative Date for transfer to IEPF |

|---|---|---|

| 2012-2013 | August 5, 2013 | August 4, 2020 |

| 2013-2014 | August 11, 2014 | August 10, 2021 |

| 2014-2015 | August 10, 2015 | August 9, 2022 |

| 2015-2016 | August 8, 2016 | August 7, 2023 |

| 2016-2017 | June 26, 2017 | June 25, 2024 |

| 2017-2018 | August 3, 2018 | August 2, 2025 |

| 2018-2019 | June 28, 2019 | June 27, 2026 |

The Shareholders are requested to claim their unencashed Dividends, if any at the earlier.

Commodity Price Risk or Foreign Exchange Risk and hedging activities

The Company has adequate Risk Assessment and Minimisation system in place including Foreign Exchange. The Foreign Exchange Risk is managed through the hedging strategy of the Company which is reviewed periodically

The Company does not have material exposure of any commodity and accordingly, no hedging activities for the same is carried out. Therefore, there is no disclosure to offer in terms of SEBI circular no. SEBI/HO/CFD/CMD1/ CIR/P/2018/0000000141 dated November 15, 2018.

Plant Locations

|

Nitrite & Nitroaromatics Division 4/12 GIDC Chemical Complex Nandesari - 391 340. Dist. Vadodara |

Taloja Chemicals Division Plot Nos. K/9-10, MIDC Taloja, Dist. Raigad - 410 208 |

|

Roha Division Plot Nos. 1, 2, 26 & 27 MIDC Dhatav, Roha - 402 116, Dist. Raigad |

Hyderabad Specialities Division : Plot Nos. 90-F/70-A and B, Phase II, Industrial Development Area, Jedimetla, Tal. Qutbyullapur Mandal, Dist. Ranga Reddy, Hyderabad 500 055 |

|

Dahej Division: 12/B/2, GIDC, Dahej, Dist. Bharuch, Gujarat – 392 130 |

|

Credit Ratings

During the Financial Year 2019-20, ICRA has upgraded long term credit rating from “ICRA A+/Positive” to “ICRA AA-/ Stable” while retaining short term credit rating at highest notch i.e. at “ ICRA A1+”; while CRISIL assigns with a long term credit rating of ‘CRISIL AA-/Stable and short term rating of “CRISIL A1+”,which is the highest rating in short term category.

ICRA has also re-affirmed the rating at [ICRA] A1+ (pronounced ICRA A one plus) assigned to the Commercial Paper programme of DNL.